Making Estimated Tax Payments For 2025. Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. If you struggled with your estimated tax payments in 2023, this guide is for you.

Making the fiscal rules more robust, moving to a single fiscal event per year, and. What are estimated tax payments?

Payment Is Due By January 15, 2025.

Do i have to make estimated tax payments?

Using A Preprinted Estimated Tax Voucher Issued By The Indiana Department Of Revenue (Dor).

How to make estimated tax payments and due dates in 2024.

Making Estimated Tax Payments For 2025 Images References :

Source: www.youtube.com

Source: www.youtube.com

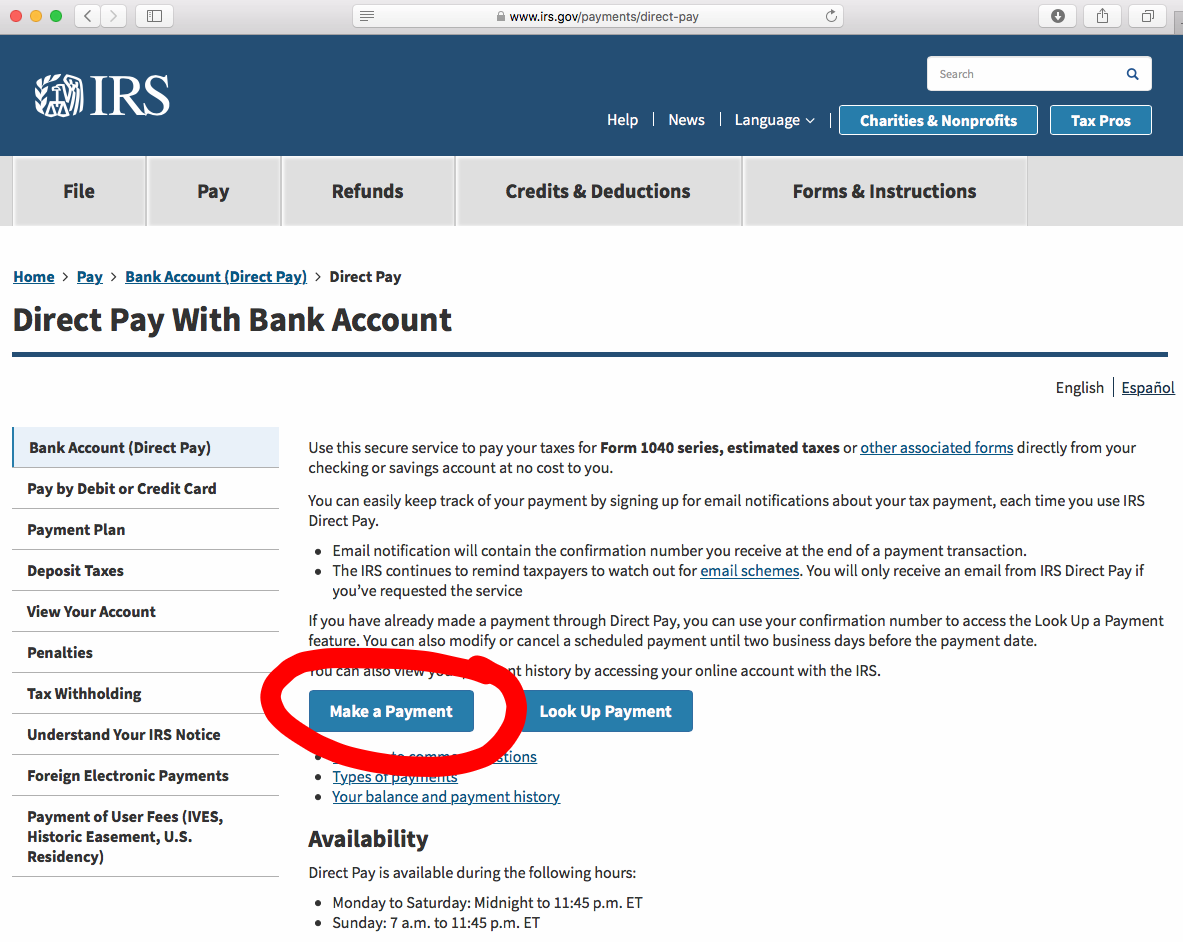

How To Make Estimated Tax Payment With IRS Direct Pay YouTube, Using a preprinted estimated tax voucher issued by the indiana department of revenue (dor). The deadlines for tax year 2024 quarterly payments are:

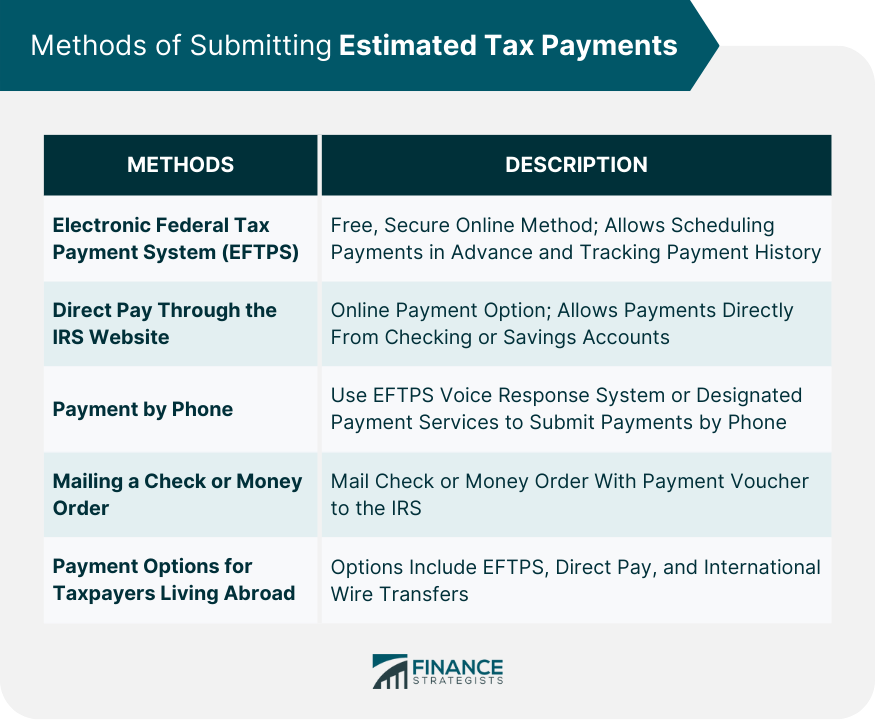

Source: www.financestrategists.com

Source: www.financestrategists.com

Estimated Tax Payments Eligibility, Calculation, and Tips, Further, reduce the tax deducted at source, or collected at source. And if you're one of them—a freelancer or small business owner, for example—you're responsible for making estimated quarterly tax payments on your own.

Source: www.youtube.com

Source: www.youtube.com

How to make estimated tax payments at directpay.irs.gov YouTube, If the amount of tax is more than rs. Advance tax payment due dates:

Source: nestpayroll.com

Source: nestpayroll.com

The Easy Guide To Making Estimated Tax Payments — Nest Payroll, Quarter 3, june 1 to august 31: Estimated tax installment payments may be made by one of the following methods:

Source: www.youtube.com

Source: www.youtube.com

Estimated Tax Payments How to Make Estimated Tax Payments Online or By, Making the fiscal rules more robust, moving to a single fiscal event per year, and. This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception.

Everything You Need to Know About Making Estimated Tax Payments as a, The program ends on january 1, 2025, 7am. For tax year 2023, the dates were:

Source: www.financialsymmetry.com

Source: www.financialsymmetry.com

Should I Be Making Estimated Tax Payments? Financial Symmetry, Inc., You may credit an overpayment on your. What are estimated tax payments?

Source: www.youtube.com

Source: www.youtube.com

How to Make Electronic Estimated Tax Payments With Peace of Mind YouTube, Quarter 3, june 1 to august 31: Her first estimated tax payment for the year is due on april 15, 2024.

Source: stratlign.com

Source: stratlign.com

Estimated Tax A Simple Guide for Business Owners Stratlign Accounting, This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception. In general, quarterly estimated tax payments are due on the.

Source: fluentricciardi.com

Source: fluentricciardi.com

Guide to Estimated Tax Payments Fluent & Ricciardi, Advance tax payment due dates: The program ends on january 1, 2025, 7am.

Advance Tax Payment Due Dates:

Estimated tax installment payments may be made by one of the following methods:

The Deadlines For Tax Year 2024 Quarterly Payments Are:

If she decides to make “quarterly” tax payments instead of paying all her estimated tax by april.

Posted in 2025